Imagine that your favorite artist starts playing while you are queueing at the bar. It takes ages as it seems that nobody has their cash ready. And when it comes to your turn, you find out that the seller is unable to give you a chance for your order. Sounds pretty annoying, right? If you haven’t experienced this lately it’s because of the technology that helps event professionals create better live experiences. In this case, we’re talking about using Cashless Payments at events. And their benefits.

Implementing innovative payment solutions at festivals has solved many issues. For event planners and festival goers alike. The scope of this article is to focus on the benefits of implementing cashless payments for your events. While this is far from being the only use case for this technology, festivals have embraced it with the highest velocity.

Later in this article, we will focus on some of the essential benefits this technology provides. Deploying a cashless payments solution at your festival will speed up transactions, prevent thefts or fraud, give you access to real-time reports, and generate new revenue streams.

Getting started with cashless payments

But first, let’s better understand what we mean actually when talking about a cashless payment system. Especially when focusing on the ones used for festivals and smaller events.

We’re all familiar with the RFID wristbands used at events. They’re used for access control and payments, allowing people to control their experiences with a simple tap of the hand. Do attendees need to pay for a beverage? A simple tap of the hand is enough Or, in a more sophisticated yet easy-to-use environment – scanning a dynamic QR will provide the same result. Do they want to access a specific area and does the support team on-site need to check their access credentials? A tap of the hand is enough. Have they pre-purchased their favorite band’s T-shirt as a ticket add-on? Yes, a tap of the hand is all they need to claim their perk. The all-mighty festival wristband guides attendees through their experience, right? Well, not really.

While I’ve showcased a journey similar to the ones available for most festivals, the wristband itself is not that mighty. But the technology that stands behind it – enabling cashless payments (and more) – is.

Going beyond just payments

The phrase “Cashless payments at events”, in its complete understanding, refers to so much more than a way of accepting payments that are not made with cash. When we talk about a festival and its payments operated through a cashless payment solution, we are actually talking about a local economy. A special ecosystem, where the event itself is the central bank of what happens within its borders. And sometimes even outside its gates.

Within the festival, there are multiple companies with economic activity. Simply put, vendors or sellers. And there is a legit need for them to accept the same payment method. To do it fast and transparently. At the same time, regardless of how many different vendors operate onsite, the organizers need to have a live overview of the economics of the event.

At festivals, depending on their size, the total number of transactions can range from a few thousand to over a million, often in less than 72 hours. You need to have a system that is fast, secure, and stable. When it comes to festivals, not being able to serve customers is probably worse than losing power at the main stage.

The “customer journey” of an event-goer

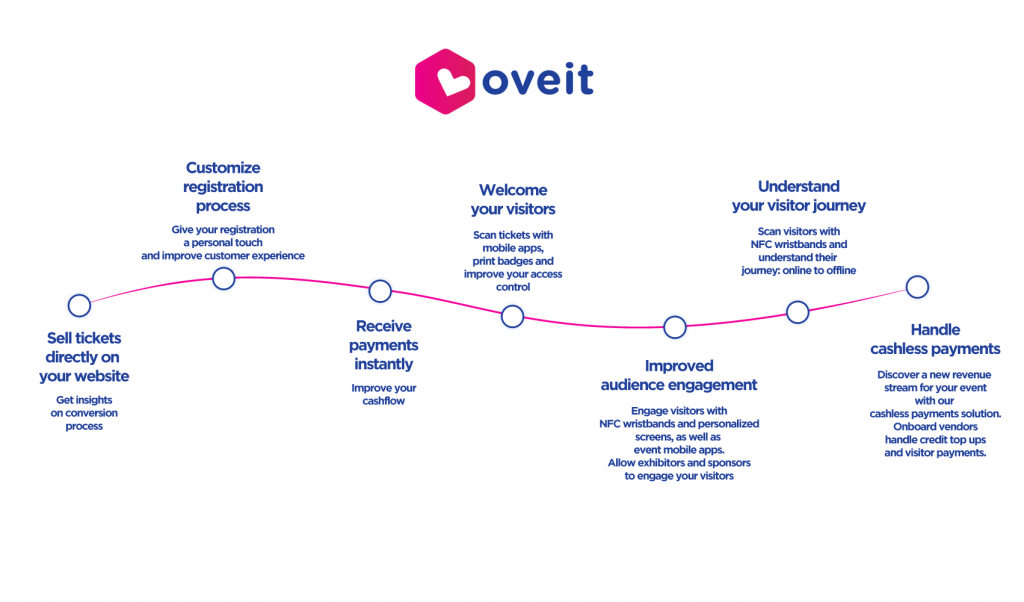

The journey for a festival goer starts long before the first note is played by their favorite band. From an operations point of view, it starts when the ticket is bought. Because, for most festivals, the ticket itself is, in fact, the digital wallet that allows attendees to pay, access special areas, claim their perks, and much more. The RFID festival wristband, used by organizers from all over the world, is the gateway that gives them access to this virtual wallet.

When buying the ticket, attendees can also opt to pre-purchase merchandise, special access, addons or top up their digital wallet.

When arriving on-site, they can pay for food, beverage, or merchandise using the cashless payment system, can add money to their digital account, and once the event is over they can withdraw their remaining funds.

Benefits of using cashless payments at events

Now that we have gone through the entire process, let’s go further and pinpoint the exact benefits of using cashless payments at events or venues. We’ll be listing the benefits one by one, while still keeping one eye on the big picture.

Cashless payments at events are fast. Very fast.

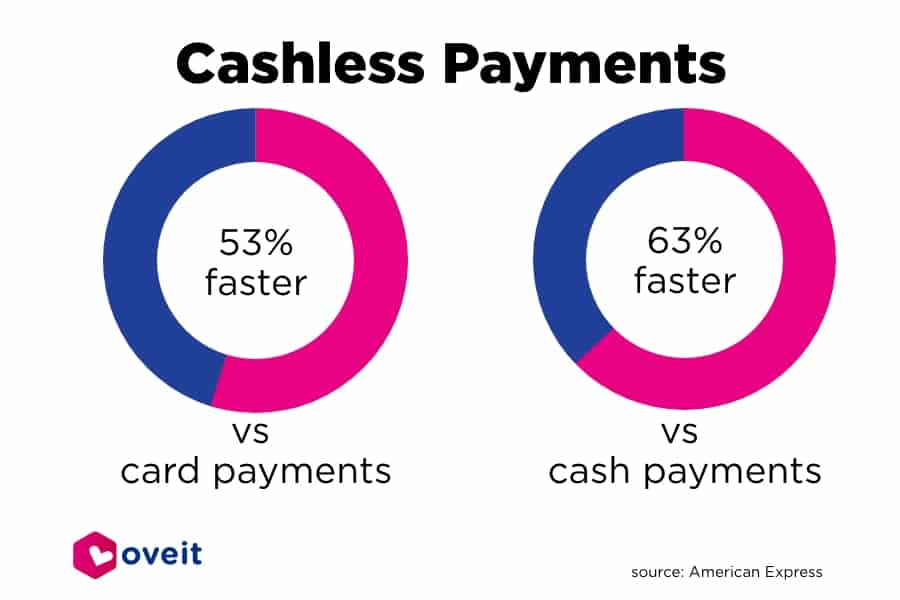

A crucial aspect of a closed-loop cashless payment system is its speed. Because the confirmation message is not required to follow the same steps as for a traditional online payment, these transactions are processed way more quicker. How much quicker? According to reports from American Express, cashless payments transactions are 63% faster than ones including cash and up to 53% faster than classic card payments.

But these differences can be even higher, as cashless payment solutions for events offer edge payment capabilities. This means that through our proprietary technology, transactions are processed locally, at the edge of the cloud, secured by a distributed ledger system, and synced online afterward.

They are easy to implement and use

Implementing a closed-loop cashless payment solution is easy. For both vendors and festival goers.

Vendors can accept payments using mobile points of sale while attendees have a payment method they are already familiar with. Vendors can easily create product catalogs, add and change prices, or remove products from sale.

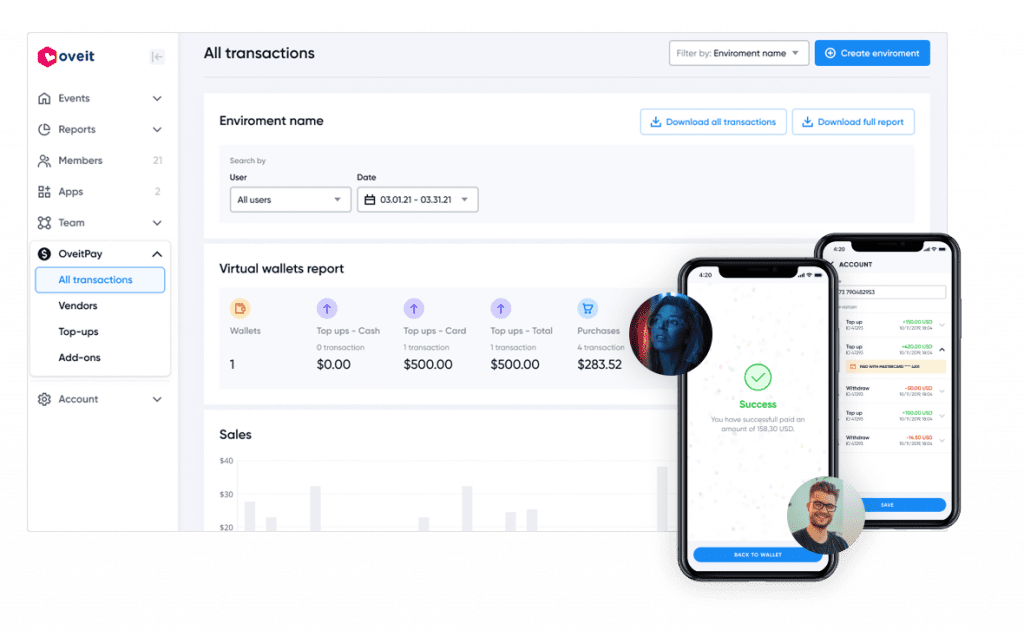

With Oveit, vendors receive an invite to your experience. They can then proceed on setting up their menus and use a mobile POS to get paid when the festival starts. From their dashboard, they can check their sales, better understanding how customers

Cashless payments are secure

With no cash changing hands within your festivals, fraud is completely eliminated from on-site transactions. At the same time, it becomes close to impossible for attendees to lose their assets. Especially when allowing them to pay with the RFID festival wristband. The data attendee’s data is securely stored in a private digital wallet, allowing them to easily access their balance and transaction history.

Creating a safe environment for your attendees is crucial. You want them to be able to enjoy the experience without having to worry about the safety of their financial assets.

While the payments are 100% secure, human errors may still appear. But with a local payment system, you can easily repair any such error. Unlike traditional online payments, where any error could be fixed by a third-party institution, like a bank, here you have the authority to fix anything. You can easily refund a client or cancel a payment in a transparent manner, keeping all stakeholders happy.

Generate new revenue streams for your events with cashless payments

You can easily onboard third-party venues in your festival economy and generate new revenue streams for your business. As food, beverage and merchandise are extremely important to any festival, using a cashless payment system helps you add new sellers while still having everything under control.

As the owner of this closed economy, you have instant access to sales data from all vendors. Adding new businesses into the space generates new income opportunities for all stakeholders. The vendor gains access to new customers and the organizer can take a cut from those sales. And attendees benefit from a more diverse experience.

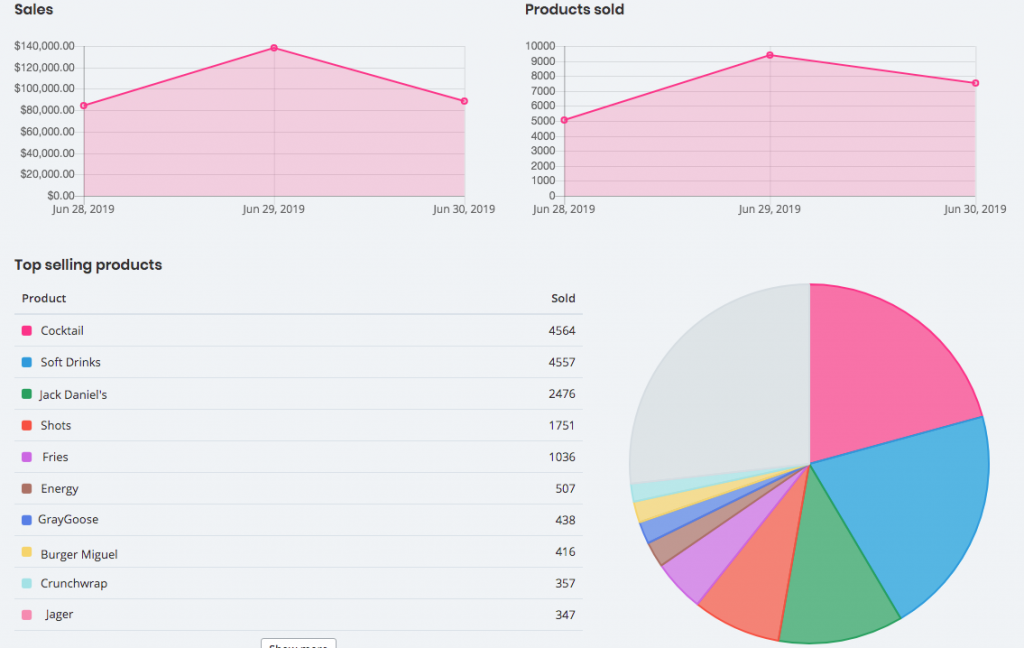

Instant access to real-time data

Unlike other businesses, festivals are extremely time-sensitive. Hundreds of people work one year to create an experience that lasts just a few days. But during those few days, each second has so much weight attached.

This is why real-time data is crucial for event organizers. This way, they adapt depending on what actually happens at the event. As mentioned above, a smart cashless payment tool keeps track not only of the payments but can also display relevant data on the customer journey.

Based on access credentials and pre-purchased perks, you can see what people are interested in buying, what areas they like to spend most of their time, and what perks they have already claimed.

Improved customer experience

Each and every benefit mentioned above increases the overall customer experience. But this is a great example of when “the whole is greater than the sum of its parts”.

Looking at the customer journey, it’s easy to understand that we can now personalize the customer experience. As a matter of fact, we can allow them to create the experiences they have always dreamed of.

Customers can create their own tickets, with special access credentials or pre-purchased merchandise, depending on their needs. They can decide how much money they will spend during the festival, where they will hand out, and which brands they decide to share their data with.

And as we all know by now, a cashless payments solution does way more than just allow people to pay. Based on the data recorded, you can better understand what people actually enjoyed and what not. And you can use that information to create new, engaging experiences.

Final words

Beyond internal processes, vendors, merchandise, and bands, festivals are about creating memories. Are about offering unforgettable experiences to your attendees. But in order to support these experiences, your operations need to run as smoothly as possible. And this is what cashless payments do to your event-goers.

They allow you to streamline the process, onboard countless new vendors, ensure fast and secure payments, and assist the entire customer journey of your attendees. And while everything runs in the background, festival goers can concentrate on one thing: having the time of their lives.